A Biased View of Estate Planning Attorney

The 2-Minute Rule for Estate Planning Attorney

Table of ContentsA Biased View of Estate Planning AttorneySome Known Details About Estate Planning Attorney A Biased View of Estate Planning Attorney3 Easy Facts About Estate Planning Attorney Explained

Retrieved 20 September 2017. Virginia Tax Obligation Testimonial. Fetched 20 September 2017.Estate preparation is concerning making certain your family recognizes exactly how you want your properties and events to be handled in the occasion of your death or incapacitation. That's where estate preparation attorneys come in.

It's likewise crucial for anyone with dependents, such as small kids, enjoyed ones with unique requirements, or maturing moms and dads. Prepping for your initial estate preparation conference can feel daunting, yet it does not need to be. Consider the 4 following actions to prepare for the estate planning procedure, complete with experienced recommendations.

The Best Guide To Estate Planning Attorney

It's essential to function with a lawyer or law company experienced in estate law, state and federal tax obligation planning, and trust fund management. Otherwise, your estate strategy can have voids or oversights. Ask good friends, household, or associates for recommendations. You may also ask your employer if they use a lawful strategy benefit, which could connect you with a network of seasoned estate preparation lawyers for a low regular monthly charge.

Having discussions with the individuals you enjoy regarding your very own passing can feel uneasy. The structure of your estate plan begins by thinking with these difficult scenarios.

Whether you're just starting the estate planning procedure or want to modify an existing plan, an estate preparation attorney can be a very useful resource. You might think about asking buddies and coworkers for recommendations. You can likewise ask your company if they offer legal plan benefits, which can help connect you with a network of seasoned attorneys for your legal requirements, consisting of estate planning.

4 Easy Facts About Estate Planning Attorney Described

You likely understand what you wish to take place to your properties, and to whom they need to go. An estate preparation lawyer should listen to your preferences and describe the choices for completing your objectives (Estate Planning Attorney). When a person dies and does not have a valid will and in location, the end result depends on the hands of go to this web-site the court and a complete stranger commonly makes these choices

While this is better than nothing, there is no way of recognizing how this will certainly stand up in court if challenged. Additionally, you miss out on out on much of the benefits you get when you work with an estate preparation lawyer. These advantages might consist of: Getting advice regarding your estate based upon the details of your financial situation Helping you consist of all possible assets in your strategy Clarifying Recommended Site exactly how taxes might impact the inheritance of your liked ones Medicaid planning and property security based on your unique circumstances Developing a durable, valid will Comfort from recognizing there is a strategy in position if you can no more make these decisions or after you pass away Bratton Law Group manages estate preparation with an interdisciplinary technique.

Full the Call us create now If you need assist with your New Jersey estate strategy, Bratton Legislation Group is right here to help. Call us today at to get going. Call or finish the Contact us form An administrator's task features lots of legal commitments. Under certain circumstances, an administrator can even be held directly liable for overdue estate taxes.

The Ultimate Guide To Estate Planning Attorney

An administrator is an individual or entity you pick to perform your last wishes detailed in your will. Your administrator ought to be somebody you trust fund is accountable enough why not try this out to handle your estate after you pass Yearly thousands of readers cast their elect the attorneys they call on in times of demand and for the 8th consecutive year, we are honored to claim that lawyer Chris Bratton has been chosen.

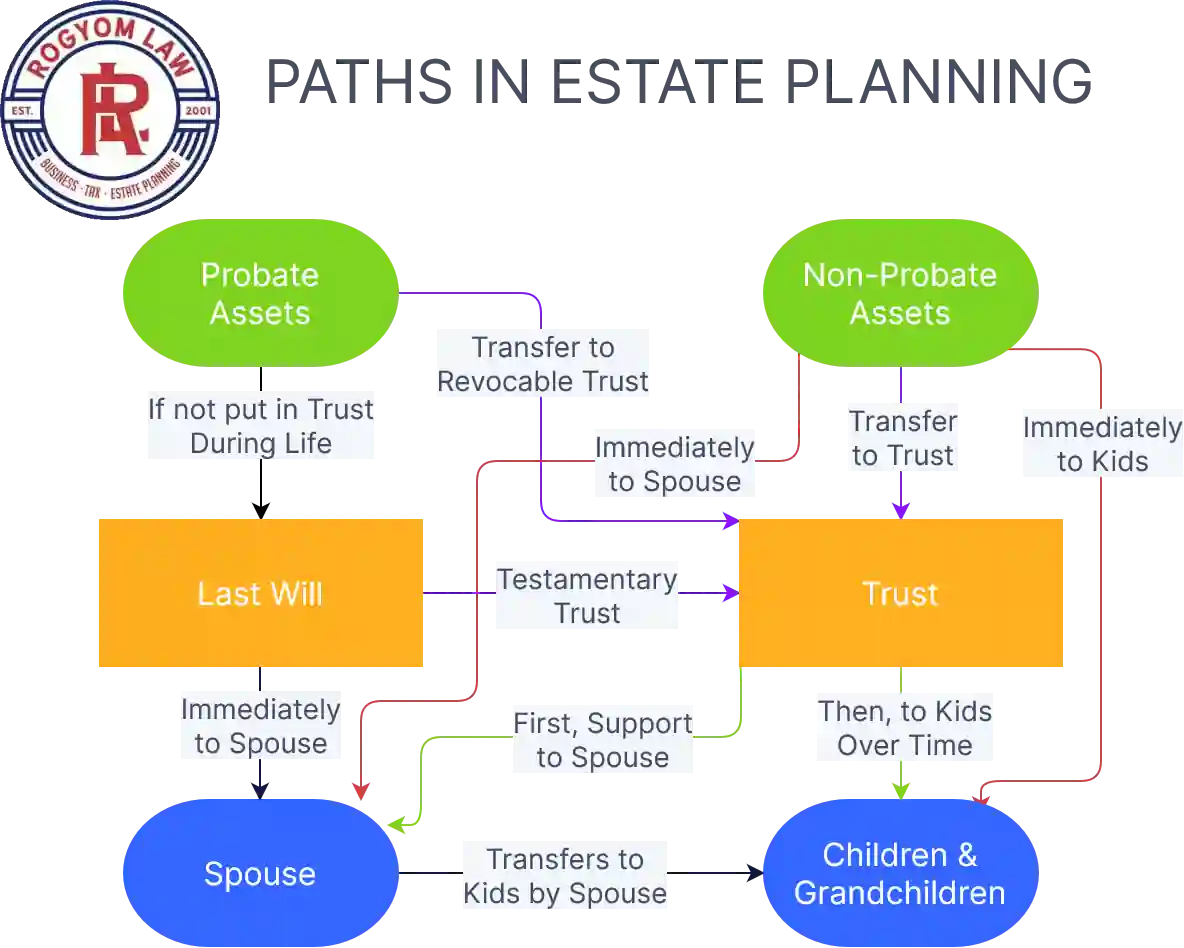

If you pass away without a will, depend on, or various other arrangement for the circulation of your cash and residential property, those assets will typically be distributed according to The golden state legislation. These intestate sequence laws are complicated, however they basically distributes your possessions to your making it through relatives based on domestic partnership. Some possessions do not undergo this procedure and instead will certainly be dispersed to enduring co-owners or to beneficiaries you marked ahead of time.

For accounts and assets with recipient designations, you can typically choose your recipient when you you're your account and can transform your recipient at any time. Inspect with the bank, insurance firm, or various other entity holding your account or property to figure out how to designate or change a recipient and if there are any restrictions.

In California, properties gotten throughout a marriage may be taken into consideration community residential property and may pass to the enduring partner when one spouse passes away. You can regulate the distribution of your assets after death by creating a will certainly or a trust fund, consisting of a living trust. You can also use a will or depend make plans for the treatment of your minor kids.